Investment

policy

The Supplemental Pension Plans Act requires retirement committees to adopt a written investment policy that takes into account the pension plan's features and commitments.

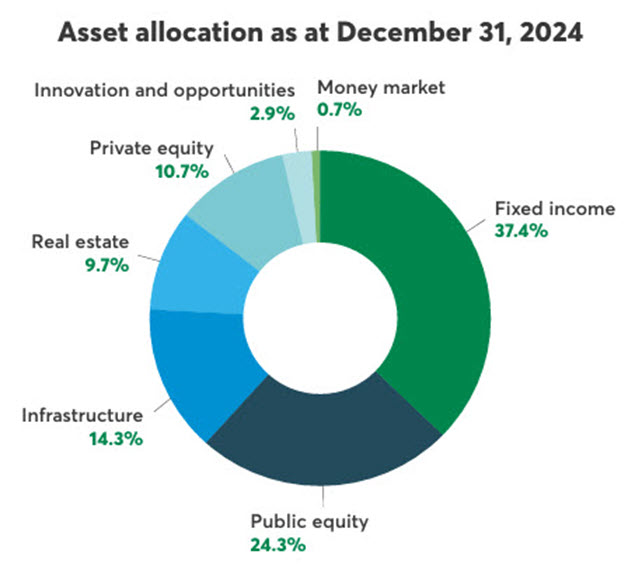

To that effect, the Desjardins Group Retirement Committee (DGRC) adopted an asset investment policy with investment objectives, strategies and guidelines, as well as monitoring procedures. Each year, the investment policy, including the target allocation for each asset class, is revised.

|

A strategy designed to protect the financial health of the Plan

Strategic allocation is designed to maximize resilience in a volatile environment and help us gradually improve the Plan's long-term financial health. We simulate a multitude of economic scenarios to ensure the achievement of these objectives in as many plausible economic contexts as possible. We continually roll out initiatives to optimize our activities and improve results.

Two separate portfolios, two different goals

The Plan’s assets are divided into 2 portfolios with different goals. These portfolios contain asset classes that are chosen to achieve the objectives of the total portfolio.

|

|

Performance portfolio

The performance portfolio aims to help the Plan achieve its long-term target return. That way, we can maintain contributions at a reasonable level for plan members and employers.

Asset class

| Objective

|

Public equity

| Take advantage of the stock market’s expected long-term returns and ensure access to emergency liquidity.

|

Infrastructures

| Generate high, predictable regular income while offering inflation protection.

|

Real estate

| Acquire real estate assets whose total return is mostly based on current income, combined with growth potential and sensitivity to inflation.

|

Private equity

| Expose the portfolio to economic growth and higher potential returns, rounding out public equity through a focus on company size and liquidity premiums.

|

Innovation and opportunities

| Take advantage of the subprime market’s credit and liquidity risk premium, and consider all innovation opportunities that could improve the overall portfolio’s risk-adjusted performance.

|

Matching portfolio

The matching portfolio aims to match assets with liabilities at the target level in order to protect the Plan’s financial health, minimize volatility and comply with the organization’s risk budget.

The Plan's liabilities, which consist of the payments promised to its plan members, are significantly affected by interest rate fluctuations. To effectively close the gap between assets and liabilities, the portfolio includes securities that are sensitive to interest rate fluctuations.

Asset class

| Objective

|

Fixed income

| Achieve and maintain the target matching level between Plan assets and liabilities to minimize volatility in the financial position.

|

Bond overlay

| Use derivatives strategies to reach the target matching level without affecting the physical portfolio in order to allocate the maximum capital to the performance portfolio.

|

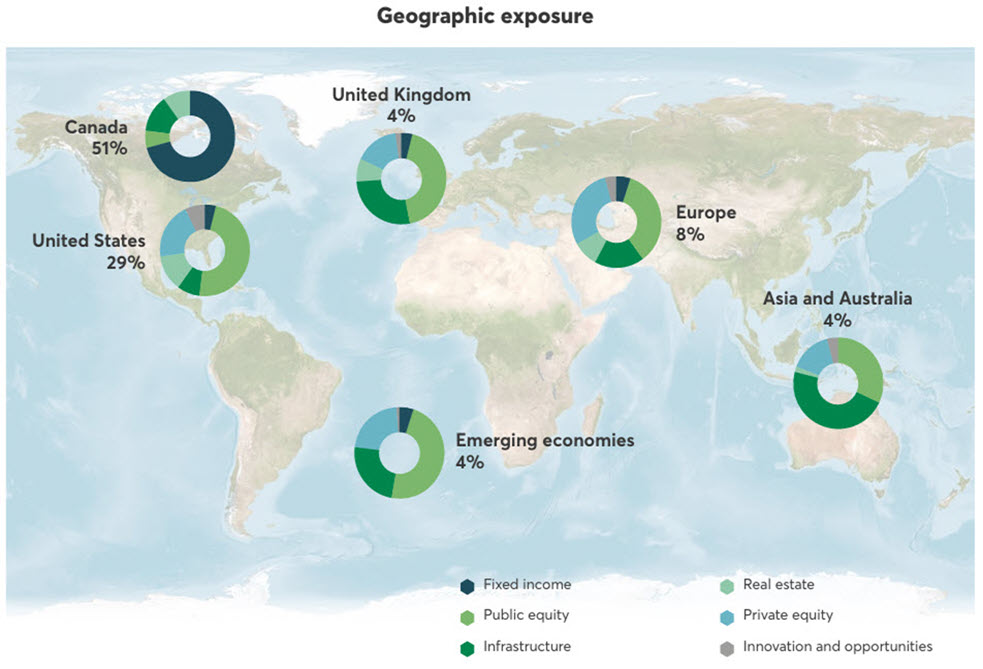

Global presence

The Plan invests worldwide, allocating capital to the most attractive opportunities and working with the best partners.

In the current environment, where there is fierce competition for high-quality assets, we stand out thanks to our well-established network of partners worldwide, with whom we make diverse investments.