Continuous service

All the years during which you worked continuously as a regular employee within the Desjardins Group, or since the beginning of your participation in the Plan, are taken into account in the calculation of continuous service. Temporary absences, such as parental leave, do not interrupt this continuity. However, any period of absence between two jobs within the Desjardins Group is excluded from the calculation. The number of years of continuous service is used to determine the early retirement reduction for years of participation prior to 2009.

In a defined benefit plan, the amount of the annuity is set in advance according to a precise formula. This formula generally corresponds to a percentage of the salary, multiplied by the credited years of service recognized by the plan.

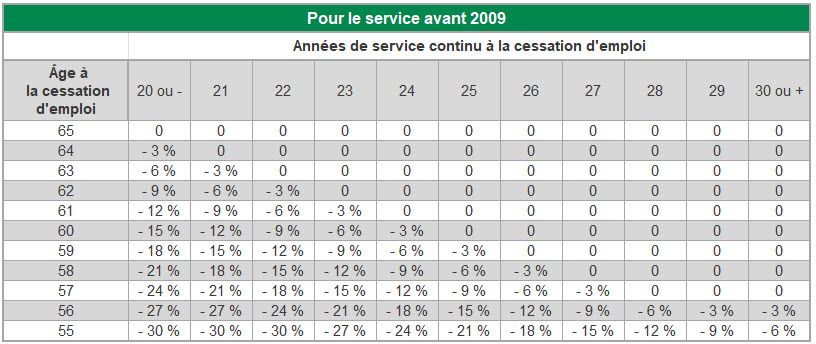

Early retirement reduction

Percentage of reduction applicable to an annuity payable at normal retirement age.

For example, if you are 58 years old with 26 years of continuous service, a reduction percentage would apply to the pension amount payable at age 65. For years of participation prior to 2009, the reduction would be 3% per year. For years of participation starting in 2009, the reduction would be 4% per year before age 62, which would result to a 16% reduction.

The tables below illustrate the early retirement reduction percentages for service prior to 2009 and for service starting in 2009.

For service starting from 2009

|

Age upon termination of employment

| 65

|

64

|

63

|

62

|

61

|

60

|

59

|

58

|

57

|

56

|

55

|

Reduction of the pension

amount

| 0 |

0

|

0

|

0

|

-4%

|

-8%

|

-12%

|

-16%

|

-20%

|

-24%

|

-28%

|

Excess contributions

Under the Supplemental Pension Plans Act, the employer must fund at least 50% of the value of your vested pension.

This means that if, at the time of your termination, your accumulated contributions with interest represent more than 50% of the value of your vested pension, the excess is added to your entitlements as excess contributions.

Locked-in Retirement Account (LIRA)

A Locked-In Retirement Account (LIRA) is a type of savings account designed to receive the money you have accumulated in a pension plan from a former employer. This account is called “locked-in” because the funds deposited in it are reserved for your retirement.

When you leave your job, the lump-sum amounts from your pension plan can be transferred into a LIRA. This account is opened with a financial institution and allows your money to grow until you are ready to convert it into retirement income. Later, you will need to convert your LIRA into a Life Income Fund (LIF), a life annuity, or transfer the funds into another pension plan.

The law sets limits on the amounts that can be transferred into a LIRA. If the value of your pension exceeds this limit, the excess will be paid directly to you, but it will be taxable. For example, if you are 50 years old or younger, the maximum transferable amount corresponds to your annual pension multiplied by 9. Between ages 50 and 55, this factor gradually increases, reaching approximately 10.4 at age 55.

Maximum Pensionable Earnings (MPE)

The MPE is the maximum annual salary on which a member contributes to either the Quebec Pension Plan (QPP) or the Canada Pension Plan (CPP). It generally varies each year.

In 2026, the MPE is $74,600.

|

Reference table for the main percentages associated with MPE |

MPE percentage

|

Corresponding amount

|

20%

|

$14,920

|

35%

|

$26,110

|

40%

|

$29,840

|

65%

|

$48,490

|

Maximum Pensionable Earnings of the last 5 years (MPE5)

The MPE5

represents the average of the last 5 years'

Maximum Pensionable Earnings under the Quebec Pension Plan (QPP) for Quebec members, and under the Canada Pension Plan (CPP) for other provinces.

In 2026, the MPE5 is $69,180.

Recognized Service

The number of years during which you participated in the Plan. For part-time work, recognized service is calculated in proportion to the actual time worked.

Recognized service is used to determine the amount of your DGPP pension.

For more information, refer to Section 5.1 of the

DGPP regulation.

Spouse for the purposes of the DGPP

In Quebec, for the purposes of the DGPP, a person is recognized as your spouse if they meet one of the following criteria:

• You are legally

married or in a

civil union with this person and are not legally separated from bed and board.

• You have been living in a

marital relationship for at least 3 years. - • You have been living in a

marital relationship for at least 1 year and:

- • a child has been or is to be born of your union;

- • you have adopted a child together;

- • one of you has

adopted the other’s child.

- • You have been living in a

marital relationship for at least 1 yearand have

designated this person in writing as your spouse.

If none of these criteria are met,

you are not considered to have a recognized spouse for the purposes of the DGPP.

At retirement, your spouse is the person identified at the time you retire. If you have a new spouse after retirement, that person cannot be recognized as your spouse under the DGPP.

Please note:

• The full definition of spouse is provided in Section 9.2 and in the appendices of the

Plan Regulation.

For more information, refer to the Spouse page.

Tax withholding on refunds

All refunds in cash are subject to tax withholding in case of termination of participation. The applicable taxes withheld vary according to the amount of the refund as outlined in the following table. The exact amount of taxes payable will be determined when filing your income tax return for the year of the refund. For participants living in the province of Québec:

|

Amount Refunded |

Provincial Tax |

Federal Tax

| Total Tax

| $5,000$ and less

| 14%

| 5%

| 19%

| Over $5,000 and up to $15,000

| 19%

| 10%

| 29%

| Over $15,000

| 19%

| 15%

| 34%

|

For participants living elsewhere in Canada:

Amount Refunded

|

Tax | $5,000 and less

| 10%

| Over $5,000 and up to $15,000

| 20%

| Over $15,000

| 30%

|

Value of the pension

The value is the amount of capital required at the time of valuation in order for there to be enough money to pay the promised pension at retirement. It is mainly influenced by pension plan features, your age, your gender, your salary and by economic parameters such as interest rates.

If you leave the Desjardins Group before the age of 55 and transfer your entitlements, you are guaranteed at least 175% of your regular contributions, plus interest (for your participation from 2009). If applicable, the settlement of your entitlements is carried out in proportion to the Plan’s solvency ratio. The value of a pension may fluctuate significantly.

To find out the estimated value of your pension, consult your annual DGPP statement, available through your DGPP

secure file.

|