| The Desjardins Group Pension Plan was set up following a review of remuneration programs that began in the mid 1970s. Its date of creation was January 1, 1979 and was the result of the merger of several pension plans in existence within Desjardins Group at that time. As was the case two years earlier for the Group Insurance Plan, the intent was to establish a single pension plan for all Desjardins organizations and employees, thereby favouring mobility within Desjardins Group. The “defined benefit” approach was chosen for the plan. At the time, this type of plan was used by most large Canadian and Québec companies as well as most government institutions. The plan designers deemed that it better reflected Desjardins’ values and would thus constitute an efficient tool to ensure the financial security of employees and retirees in the long term. On the date of its creation, the new plan had nearly 10,000 active and retired members. As the plan arose from the merger of several plans, these members were credited with initial service credits passed along according to a formula established by the Fédération Board of Directors which, like today, acted as Plan sponsor for all the employers. This formula contained a mechanism for upgrading the pension, both for active employees and for retirees. Thus, for service before 1979, each member was credited with a fixed indexed pension that gave the member greater credits than those acquired under the former plan, and each retiree saw their payable pension increased. The employers assumed the full costs of this upgrade, which represented no less than $12 million. Starting in 1979, the new plan included the following features: - A formula for calculating pension at age 65 which, proportionally to the years of participation on in the plan, takes into account both the average salary for the best five years (salary 5) and the income the employee should receive from the Quebec Pension Plan or the Canada Pension Plan, based on the last three yearly maximum pensionable earnings (MPE3). The formula is as follows: (2% X years of contribution X salary 5) less (0.7% X years of contribution X MPE3).

- The application of an actuarial adjustment in case of early retirement of 3% per year before age 65; since this is the normal retirement age for the plan, an employee could opt for early retirement starting at age 55 and would then have an actuarial adjustment of 30% applied. If the employee instead opted to retire at age 60, the adjustment was 15%.

- Pension indexing according to the Consumer Price Index, up to a maximum of 3% per year.

- In case of termination of service before retirement, members could choose to maintain a deferred indexed pension in the plan, if they were at least 45 with 10 years of continuous service at Desjardins. In any other circumstances, members would have their contributions refunded with interest.

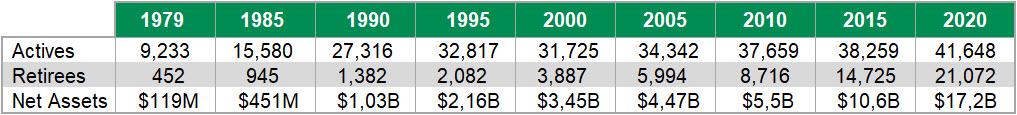

A plan adapted to the changing context at Desjardins Group Over the 30 years following its creation, the Desjardins Group Pension Plan has gone through many changes, including several that constitute tangible improvements for active and retired members. The data below, taken from the Annual Reports of the Retirement Committee give a good idea of how the plan has changed.

Here is a summary of the main changes to the plan: 1983

The actuarial adjustment formula, for early retirement before age 65 was improved. At that point, the “85 to 60 years” rule was introduced; thus employees retiring at age 60 or over and for whom the sum of their age and years of service was 85 or more, would not have the actuarial adjustment applied. 1989

Pension credits for service before 1979 were improved. From then on, years of participation before 1979 as of age 25 onwards would lead to pension credits equivalent to those for years of participation credited after 1979. This service buy-back was very beneficial for the affected employees.

We also proceeded with another improvement to the actuarial adjustment formula for employees aged 55 to 59 and who had at least 26 years of continuous service in Desjardins. Finally, there was an upgrade to the retirees’ pension to lessen the effect of inflation, which was higher than the 3% maximum per year already covered by the basic automatic indexation provided by the plan. 1990

This was the year when the new Quebec Supplemental Pension Plans Act came into effect. In accordance with the legislation, the Fédération Board of Directors adopted several measures – including some that went further than the minimum required by the new law.

In case of termination of service, the law provides that pension benefits starting in 1990 should be considered as vested to the member, as soon as the member has two years or more of participation in the plan. Desjardins chose to extend this measure to all years of participation before and after 1990. As intended by the law, all the benefit value upon termination of service would, from then on, be transferred to a locked-in retirement account. Finally, the plan should make sure that the contributions paid by the member with interest do not finance more than 50% of the value of the benefits established upon termination of service. Otherwise, the member would be attributed with so-called “excess” contributions. The normal pension for the Plan which, up to then, was a life annuity guaranteed for 10 years now became, for the new retiree with a spouse, a 60% joint and last survivor lifetime annuity, including a payment guarantee of 60% for 10 years to the retiree’s beneficiary. In 1994, the Board of Directors extended the application of this measure to all retirees having taken their retirement while they worked for Desjardins. For employees without spouses, the normal pension became a life annuity paid to the beneficiary and guaranteed for 15 years. Finally, the law eases eligibility criteria to the pension plans. Thus, eligibility became optional for employees under 25 years of age. Also, any employee hired on a temporary or casual basis could become eligible if the employee met the criteria for hours worked or minimum income earned as set out by law. 1996

The caisses reengineering was going full strength. Several measures were put in place to support employee management following the mergers of numerous caisses. The pension plan was used and a “temporary early retirement program” was offered to any employee who would choose to retire between January 1, 1996 and December 31, 1998. This program made it possible for the retiree concerned to receive a temporary pension based on the pension that would be payable by the Quebec Pension Plan or the Canada Pension Plan, in proportion to the years of participation in the Desjardins Group Pension Plan. 1997

The “85 points” rule was introduced into the plan on a continuous basis. Thus, any employee retiring at age 57 or more where the total of the employee’s age plus his/her years of continuous service added up to 85 or more was not subject to the actuarial adjustment. 1998

A specific measure was implemented for employees hired by a Desjardins Group component before January 1, 1990. The plan offered these employees the opportunity to buy back the entire period worked between the age of 24 and 25. In order to make this buy-back more interesting, the plan granted a subsidy of 30% for a maximum of $2,000 to buy back the entire year. 1999

The “temporary early retirement program” is extended. The program would remain in effect from January 1, 1999 to December 31, 2000. In addition, for the same period, the actuarial adjustment was reduced by applying the 85 points rule to age 55. 2000

As a result of excess surplus in the Plan, a lump sum amount was paid to retirees. To benefit from it, the retiree had to have retired when employed by one of the Desjardins components and, depending on their years of participation in the Plan, could receive an amount of up to $5,000. 2001

A new “Temporary retirement assistance program” was set up. It was aimed at employees who would retire between July 1, 2001 and June 29, 2003. In addition to the payment of a temporary pension, the program provided a 50% reduction of all applicable actuarial adjustments. 2002

A second lump sum amount was paid to retirees based on the same terms as previously attributed. 2002 to 2008

During this period there were no changes made or temporary measures added to the Plan. 2009

Major changes were made to the Desjardins Group Pension Plan so that it would be better aligned on future challenges for managing human resources. As with many other organizations, Desjardins Group components will have to deal with the accelerated aging of the population and its expected effects on the labour market. Desjardins undertook the implementation of various measures aimed at promoting the attraction and retention of employees in the years and decades to come. The Desjardins Group Pension Plan will contribute to meeting these new challenges by making the following changes, which will affect only years of participation starting on January 1, 2009: - Change to the formula for calculating the amount of the pension, which will be an advantage to all active plan members – and even more so to those whose salary is less than the maximum pensionable earnings as determined by the Quebec Pension Plan or the Canada Pension Plan.

- Change to the actuarial adjustment formula for early retirement. Early retirement remains possible starting at age 55. However, for the participation years in question, the actuarial adjustment will be 4% per year before age 62.

- Establishment of a transitional measure to facilitate the passage to new terms for calculating payable pension. This measure provides that any member who, under the terms in effect before January 1, 2009, could have received a pension without an actuarial adjustment before December 31, 2013, will now receive a pension at least equal to what they would have obtained from the plan before the changes effective January 1, 2009.

- New terms in case of termination of service before retirement. Members can still choose between leaving their credits in the plan in the form of a deferred pension or asking to receive the value of their credits in a locked-in retirement account. However, the new terms below apply for the years of participation after January 1, 2009.

- Indexation of deferred pension or portions of deferred pension accrued for years of participation after January 1, 2009 is now changed to correspond to the minimum required by the Supplemental Pension Plans Act. This indexation will be limited to 50% of the Consumer Price Index, (maximum of 2% per year) up to age 55. Beyond that age, no indexation will be attributed. In addition, members with a deferred pension who ask to receive their retirement pension before age 65 will receive a pension actuarially equivalent to the one payable at age 65.

- The transfer value of vested rights after 2009 will be subject to the payment of a minimal benefit equal to at least 175% of the employee contributions paid since 2009 with interest.

2013

The economic environment in the past few years and demographics are such that the plan is increasingly expensive to sustain for both Desjardins Group employees and employers. To continue to offer its young and more seasoned employees an excellent retirement plan-one that takes everyone's ability to pay into account-changes are made in January 2013. The consultations held last May with employees and officers greatly influenced the changes we decided to implement. These changes apply only to future years, and not to past years of service that have already been paid into the plan. This means that for the years of service accumulated before 2013, pension benefits are calculated based on the plan's previous provisions. The new provisions apply only to the years of service worked as of January 2013. Pension benefit formula

The pension formula for the calculation of the pension amount is modified. For years of service accumulated as of 3013, the final salary is determined based on the employee's best eight years of earnings. Benefit protection in the event of death

For years of service accumulated as of January 2013, the protection in the event of death after retirement remains the same, regardless of mariatal status. The plan provides employees a lifetime annuity with guaranteed benefits in the event of death for 10 years, whether or not they have a spouse. At retirement, employees can choose from among different options to meet their specific needs, including the 60% reversibility option for the spouse. The pension amount is then adjusted based on the value of the option selected by the employee. Indexation

Pension indexation after retirement is partially retained since it is an important provision to Desjardins Group employees. However, review the approach and formula used so that we can best abide by everyone's ability to pay. For years of service accumulated as of January 2013, the benefit payable will be subject to indexation as of age 65 for a 10-year period, up to a maximum of 1% per year based on the Cosumer Price Index. A prorata will apply the first and last year of indexation. Indexing will be payable from January 1 following reaching age 65 or after retirement if it started after age 65. |