| My pension plan

(0 min 45 s)

What type of pension plan is the Desjardins Group Pension Plan (DGPP)?

What are the advantages of the plan? |

Desjardins Group has chosen to offer its employees a

defined benefit pension plan. This type of plan provides greater security at retirement, because the commitment made to the employee takes the form of annuity payments calculated according to a pre-set formula that takes into account the number of years of membership in the plan and the recognized salary during the final years of work.

Desjardins Group did not choose to use a defined contribution pension plan, which is an accumulation of savings, as it considers that this type of plan carries greater risk for the employee. Under such a plan, investment returns and the interest rates in effect when the capital is converted into the annuity are directly reflected on the retirement income that the employee would receive. With this type of plan, all the risks are borne by the employee, and it is harder to make an accurate estimate of the pension the employee would receive upon retirement.

The DG Pension Plan is different from other plans for several reasons:

• Attractive employee/employer cost-sharing ratio (35/65)

• Competitive formula for calculating pension at age 65

• Favourable early retirement conditions

• Indexation of pension upon retirement, based on a known limit

• Great flexibility in pension forms, including several focused on the financial security of the retiree’s spouse

The objective of the DGPP is to provide you with retirement income that will be based on your years of credited service to the Plan and your average earnings. For years of credited service to December 29, 2012, the amount of your pension will take the average earnings of your best 5 years (salary5) into account. For years of credited service as of December 30, 2012, the amount of your pension will take the average earnings of your best 8 years (salary8) into account. In addition, the DGPP will take the pensions paid by the Québec Pension Plan and the Canada pension plans into account. Thus, at the normal retirement age of 65, your pension will be calculated as follows:

|

Pension calculation |

Pension payable |

|

Years of service

| |

Pension credit 1

| |

Average salary | |

(Sum of 3 periods) |

Before 2009

|

Credited years |

X |

1.3% / 2%

|

X |

Best 5 years

|

= |

DG pension payable at age 65 (A) |

From 2009 to 2012

|

Credited years

|

X |

1.5% / 2%

|

X |

Best 5 years

|

= |

DG pension payable at age 65 (B)

|

After 2012

|

Credited years

|

X |

1.5% / 2%

|

X |

Best 8 years

|

= |

DG pension payable at age 65 (C)

|

Total paid by the plan, on top of QPP/CPP:

|

A + B + C 2

|

¹ The pension credit gives a percentage (1.3% or 1.5%) of average salary up to

average maximum pensionable earnings (MPE5)

and 2% of average salary exceeding average MPE5.

² The DGPP pension payable cannot be greater than the maximum for tax purposes.

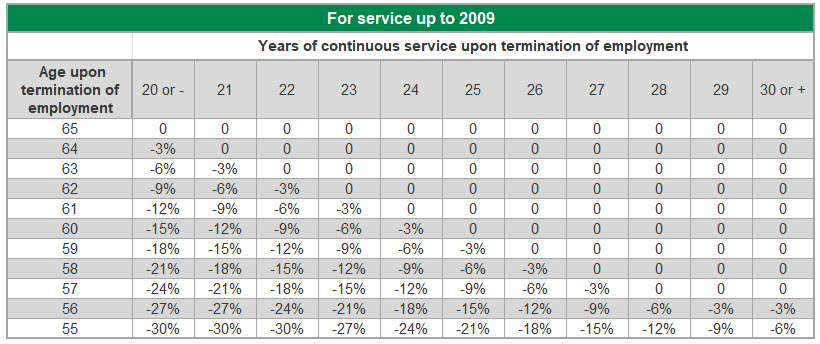

Starting at age 55, you may retire early. A downward adjustment percentage may then be applied to the pension payable at age 65. For years up to December 31, 2008, the adjustment takes into account your age and your years of continuous service upon termination of employment.

The maximum adjustment equals ¼ of 1% for each month missing before your 65th birthday. However, if the “85 at age 57” rule indicates a lesser reduction, that percentage will apply.

For example, according to the following table, the percentage of adjustment applicable on the portion of the pension payable at age 65, for the years of membership credited up to December 31, 2008, for a 58-year-old employee with 26 years of continuous service, is 3%.

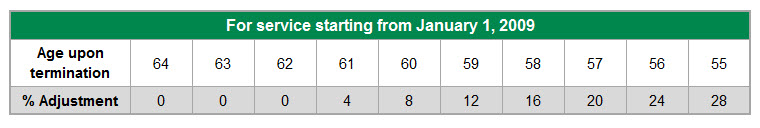

For years as of January 1, 2009, the adjustment is 4%/year for years missing between your age at retirement and age 62.

Once you have calculated the amount of pension payable at age 65 under the DG Pension Plan, you must then subtract the adjustment amount determined using the preceding table.

Your pension, if you take early retirement, will be calculated as follows:

|

Pension calculation |

Before 2009

|

DG pension payable at age 65 |

- |

Adjustment if retirement before age 65 (%)

|

= |

DG pension payable upon retirement (A) |

From 2009 to 2012

|

DG pension payable at age 65

|

- |

Adjustment if retirement before age 65 (%)

|

= |

DG pension payable upon retiremente (B)

|

After 2012

|

DG pension payable at age 65

|

- |

Adjustment if retirement before age 65 (%) |

= |

DG pension payable upon retirement (C)

|

Total paid by the plan, on top of QPP/CPP:

|

A + B + C1 |

¹ The DGPP pension payable cannot be greater than the maximum for tax purposes.

You can postpone retirement until you end your period of continuous employment, provided that this is no later than the last day of the calendar year you reach age 71. The pension payable at that time will equal the highest pension amount provided for in the Plan By-Laws.

For service accumulated up to 2012-12-29

-

If you have a spouse when you retire, the normal pension form is:

60% joint and survivor life annuity, guaranteed for 10 years.

In other words:

For you: The normal pension under the Plan is payable for life.

For your spouse: When you die, the person you identified as your spouse when you retired is entitled to a lifetime pension equal to 60% of the pension you were receiving.

For your beneficiaries: In addition, should you and your spouse die before the end of the 10-year guarantee period, the beneficiary will receive the current value of the pension your spouse would have received until the end of the 10-year guarantee period.

-

If you do not have a spouse when you retire, the normal pension form is:

Life annuity, guaranteed for 15 years.

In other words:

For you: The normal pension under the Plan is payable for life.

For your beneficiaries: Your pension also carries a 15-year guarantee period. Therefore, should you die before the expiry of this 15-year guarantee period, your beneficiary will receive a lump-sum payment for the present value of the full pension you would have received until the end of the 15-year guarantee period.

For service as of 2012-12-30 - The normal form of pension will be the same from now on, regardless of marital status.

Whether or not you have a pouse when you retire, the normal form of pension is:

Life annuity, guaranteed for 10 years.

In other words:

For you: The normal Plan pension is paid to you for your entire life.

For your beneficiaries: Should you die before the end of the 10-year guarantee period, your beneficiary will receive the present value of the pension to which you would have been entitled until the end of the 10-year guarantee period, in a single lump sum payement of 100% of the pension.

For service accumulated up to 2012-12-29 -

If you have a spouse when you retire, the normal pension form is:

60% joint and survivor life annuity, guaranteed for 10 years.

In other words:

For you: The normal pension under the Plan is payable for life.

For your spouse: When you die, the person you identified as your spouse when you retired is entitled to a lifetime pension equal to 60% of the pension you were receiving.

For your beneficiaries: In addition, should you and your spouse die before the end of the 10-year guarantee period, the beneficiary will receive the current value of the pension your spouse would have received until the end of the 10-year guarantee period.

-

If you do not have a spouse when you retire, the normal pension form is:

Life annuity, guaranteed for 15 years.

In other words:

For you: The normal pension under the Plan is payable for life.

For your beneficiaries: Your pension also carries a 15-year guarantee period. Therefore, should you die before the expiry of this 15-year guarantee period, your beneficiary will receive a lump-sum payment for the present value of the full pension you would have received until the end of the 15-year guarantee period.

For service as of 2012-12-30 - The normal form of pension will be the same from now on, regardless of marital status.

Whether or not you have a pouse when you retire, the normal form of pension is:

Life annuity, guaranteed for 10 years.

In other words:

For you: The normal Plan pension is paid to you for your entire life.

For your beneficiaries: Should you die before the end of the 10-year guarantee period, your beneficiary will receive the present value of the pension to which you would have been entitled until the end of the 10-year guarantee period, in a single lump sum payement of 100% of the pension.

For service up to 2012-12-29: The vested benefit will be indexed at the beginning of each year. The indexation is based on that of the RRQ retirement pension, with a maximum of 3% per year.

However, the indexation of your pension will be adjusted accordingly if, when you retire, you have opted for the “indexed and unindexed annuity” form following your decision to eliminate or reduce the applicable actuarial adjustment for early retirement.

For service as of 2012-12-30:

The vested benefit will be indexed at the beginning of each year after you reach age 65, or at the beginning of the year following retirement, if you retired after age 65, to take into account the increase in the Consumer Price Index (maximum indexing of 1%) for a defined period of 10 years. A prorata applies to the first and last year of indexing. However, your pension for service before and after 2012 will be adjusted accordingly if, at the time of retirement, you opted for the "indexed and unindexed annuity" after your decision to eliminate or reduce the actuarial adjustment applicable for early retirement.

However, the indexation of your pension will be adjusted accordingly if, when you retire, you have opted for the "indexed and unindexed annuity" form following your decision to eliminate or reduce the applicable actuarial adjustment for early retirement.

|

|